How to amass 800K miles in 6 months — and fly round-the-world four times in business class

A step-by-step guide to amassing 800k miles in 6 months, selecting credit cards, & redeeming business class round-the-world itineraries.

For many, circumnavigating the globe in business class is on the bucket list. But what if I told you that this airborne dream is just 6 months away? Better yet, that you could go round-and-round FOUR times! Buckle up!

This post will whisk you through the art of choosing the most rewarding points, the cards I personally applied for, the accompanying costs, and, to sprinkle a bit of wanderlust, a few enticing round-the-world itineraries.

Choosing the high-value cards: Not all points are equal

Much like diamonds, some credit card points shine brighter than others. Their brilliance hinges on two major factors: ease of earning and the versatility of transferring to travel partners.

Points Earnability: Maximizing Every Swipe

Hypothetically, imagine a world where credit card bonuses rain down, and you have an umbrella made of eligibility. Here, your bounty is determined by the unique credit card lineup each bank offers.

Amex boasts a massive spectrum of cards offering Membership Reward points as sign-up bonuses. Their array is very comprehensive, often offering multiple variants of both the personal and business cards which allows you to double-dip sign-up bonuses. For example, Amex has four unique flavors of the Platinum card:

- Personal Platinum Card for Amex

- Charles Schwab Platinum Card

- Morgan Stanley Platinum Card

- Business Platinum Card

There’s more! Amex also offers both personal and business versions of their Gold and Green cards. If you time your application during their elevated bonus offers, you could reap a good haul of points.

Chase isn't far behind. But with their notorious 5/24 rule, they're a bit stricter with issuing cards. Their redeeming grace is an enticing business card portfolio, often with substantial sign-up bonuses.

As for Citi, Capital One, and Bilt, they're a tougher nut to crack. It’s difficult to amass a substantial amount of points with their relatively anemic card offerings.

Earnability Rankings:

- Amex

- Chase

- Citi, Capital One

- Bilt

Points Transferability: The Road to More Rewards

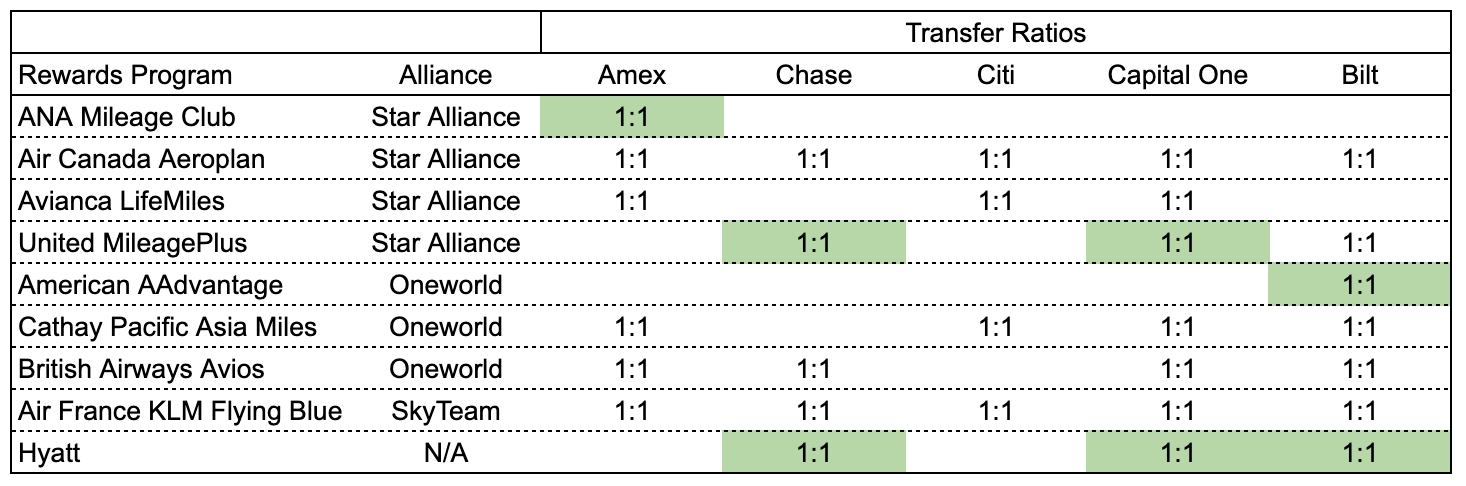

Transferability is a cornerstone in point prioritization. Different programs play host to diverse travel transfer partners. It’s important to not just rack up points, but also to utilize them effectively.

Amex leads the pack due to its extensive travel partners. It’s shining star? Their sole partnership with ANA, which offers one of the most affordable round-the-world award redemptions. Given Amex’s high earnability, I tend to prioritize it for my six favorite transfer partners, before even thinking of tapping into other programs.

Chase comes in next. It’s trump card is with unique transfer partners: United and Hyatt. Chase points are my go-to for Hyatt redemptions, especially since I often get a redemption value of more than 2 cents per point (cpp). For domestic US flights, I might keep some Chase points aside for United, although, with their recent devaluations, I am more hesitant.

Bilt stands out for their partnership with American Airlines. Despite the challenge in earning these points, their redemption power cannot be overlooked. Imagine flying first-class from the US to Japan on Japan Airlines for just 80,000 miles. Or flying QSuites in Qatar Airways from the US to Africa via Doha for just 75,000 miles — that’s over 24 hours of premium in-flight time!

I will allocate Citi points towards Wyndham Rewards so that I can take advantage of their redemption partnership Vacasa which offers fantastic value. (Capital One also transfers to Wyndham)

To sum up, while each points currency has its strengths, their transferability determines how I prioritize them:

- Amex

- Chase

- Bilt and Capital One

- Citi

My Top Credit Card Picks: Optimizing my Points Portfolio

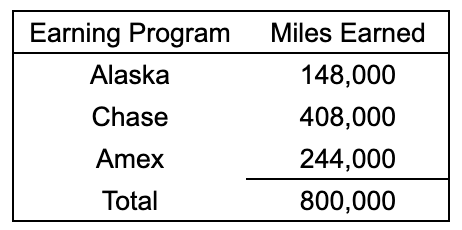

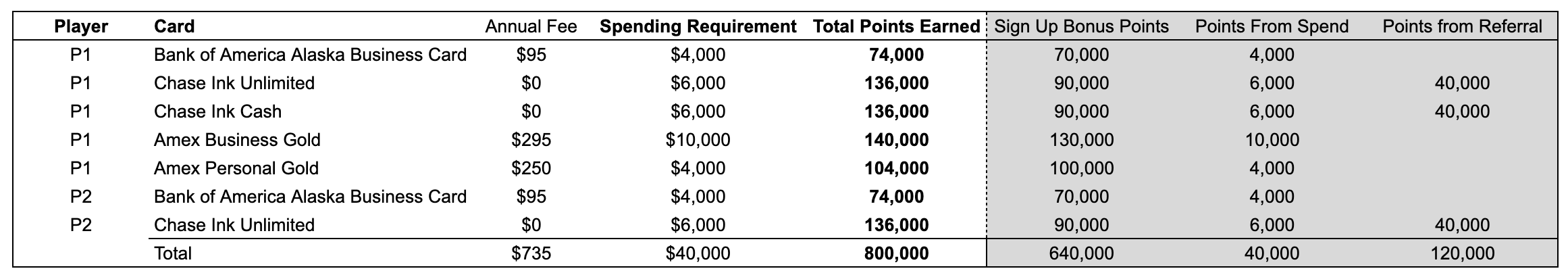

Here’s a peek into my recent round of credit card applications, optimized for my points portfolio. This is not a prescriptive list. Your credit card signups should be determined by your points portfolio. My mix is notably dense with Chase and Alaska points. Not because I have an affinity for cold places, but I have previously amassed a substantial amount of Amex points and wanted to diversify. Alaska points are gold for their partner award redemptions. And Chase? Hyatt properties have some of the best loyalty programs, and I wanted to take advantage of the Globalist perks like free suite upgrades during my sabbatical.

In numbers: 7 cards signed up over 6 months using a P1/P2 strategy yielded me 800,000 points. But how did I meet the $40K spending requirement? Leveraging everyday expenses, I took care of $15K. The masterstroke was prepaying $25K in income taxes. It’s not often you hear someone excited about taxes, but credit card points tend to make things better.

By the way, churning is easier when you have a Player 2. By using a P1/P2 strategy, not only can you sign up for the same card twice (double the joy!), but you can also earn referral points.

Investment vs. Returns: The True Value of Points

Here's the jaw-dropping bit: I spent just $1,120 for a whopping 800,000 points. By my conservative estimate at 2 cpp (cents per point), that's a $16,000 value! $735 went towards annual fees, and the remaining $475 covered card processing fees (1.89%) when paying income taxes. If you're ever wondering whether it's worth it to spend thousands in annual fees to rack up points, I explain in my post [The Economics of Credit Card Churning] why the answer is always: yes!

Round-the-world Sample Itineraries

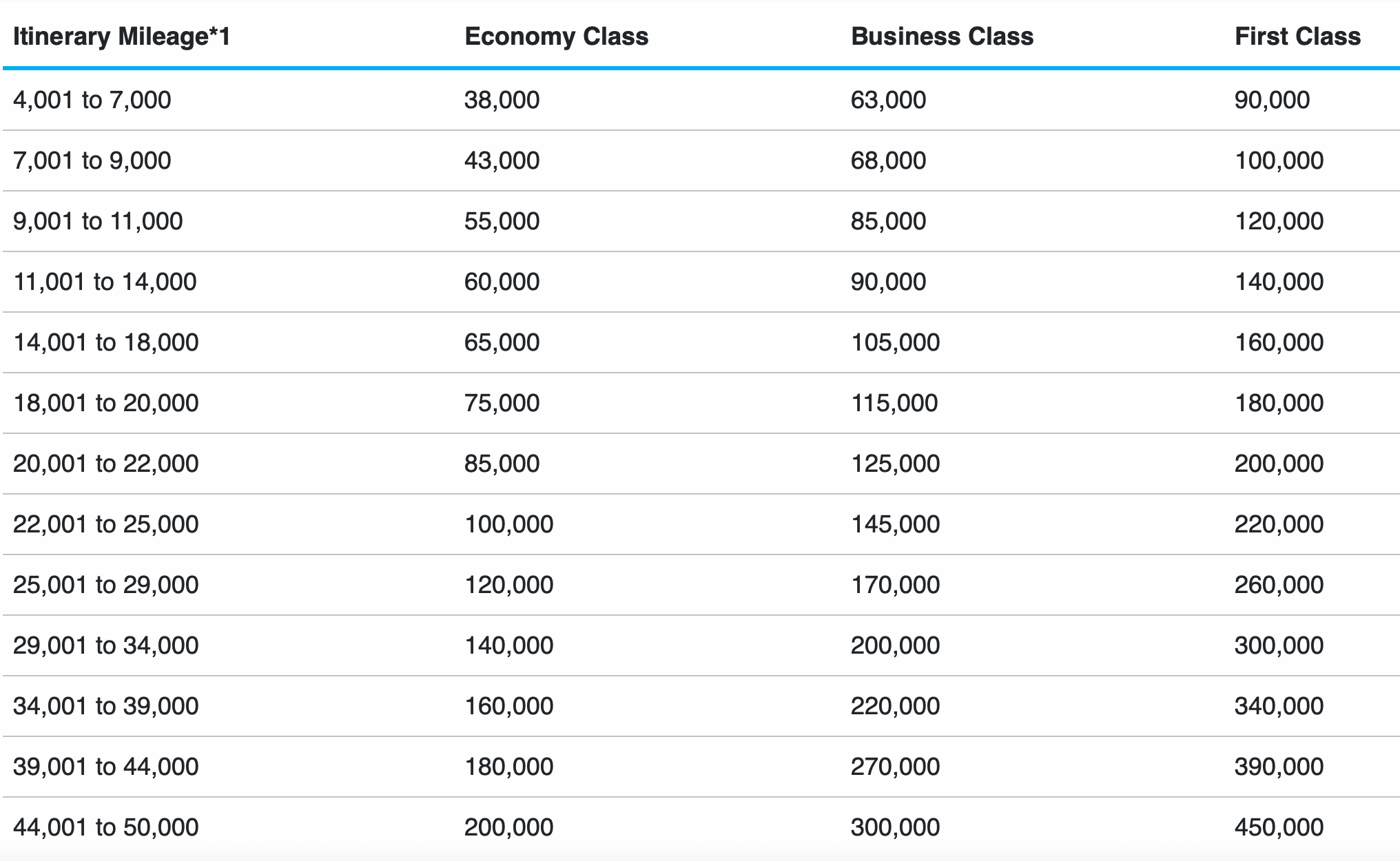

What can one do with all those newly-minted points? ANA offers attractive round-the-world business class redemptions using a distance-based award chart. Get as creative as you want with flight routings, as long as they’re on Star Alliance carriers. I used Flight Connections to explore Star Alliance routes. For award availability, the United Airlines website and Expert Flyer are my go-to tools, with ANA’s site for final confirmation.

To get your creative juices flowing, here’s a few trips you can embark on with ANA’s round-the-world-award.

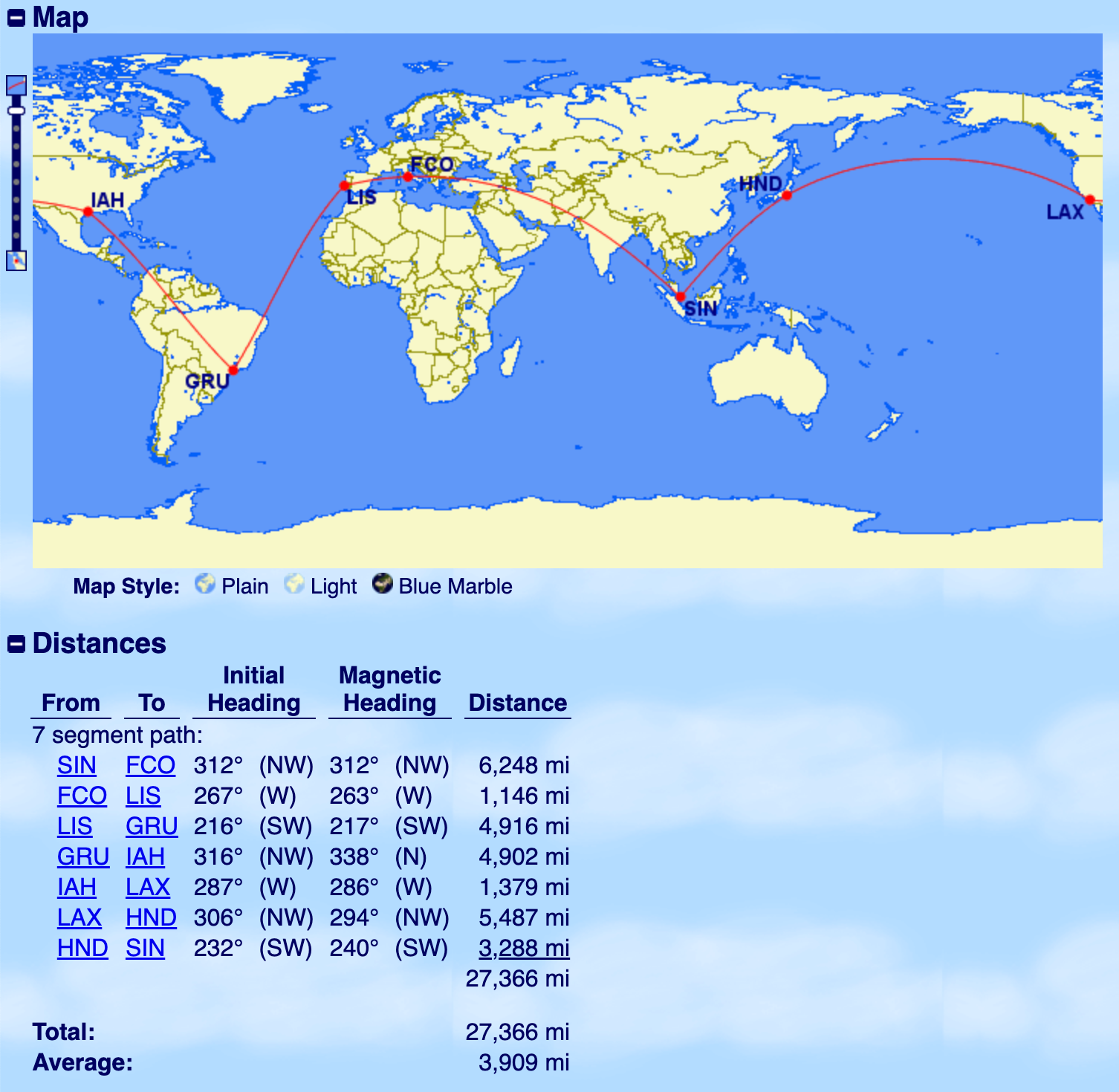

Singapore Skylines to Roman Ruins, Lisbon Lanes, Brazilian Beats, LA Lights, and Tokyo Towers: A Global Glide

Traversing 27,366 miles entirely in business class, this itinerary costs just 170K Amex points.

- Singapore to Rome on Singapore Airlines,

- Rome to Lisbon onward to Sao Paulo on TAP Portugal,

- Sao Paulo to Idaho onward to Los Angeles on United Airlines,

- Los Angeles to Haneda on ANA, and

- Tokyo (Haneda) to Singapore on ANA or Singapore Airlines.

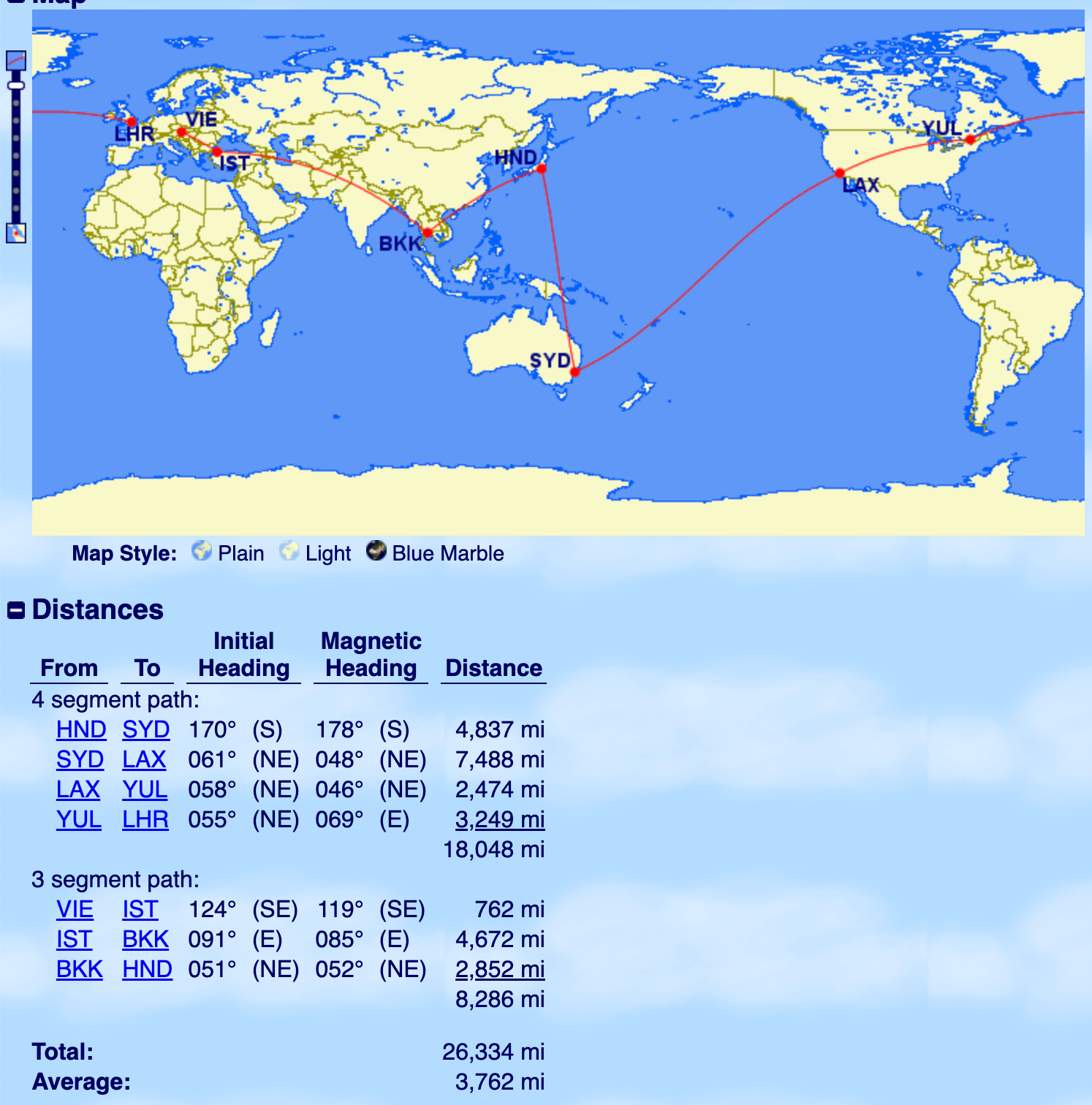

East Meets West: A Global Hop from Tokyo Skies to Istanbul's Minarets, with Stops Down Under and Across the Atlantic

This itinerary also falls below the 29,000 mile threshold and will set you back 170K Amex points.

- Tokyo (Haneda) to Sydney on ANA

- Sydney to Los Angeles on United

- Los Angeles to Montreal and onward to London (Heathrow) on Air Canada

- London to Vienna (Open Jaw)

- Vienna to Istanbul and onward to Bangkok on Turkish Airlines

- Bangkok to Tokyo (Haneda) on ANA or Thai Airways

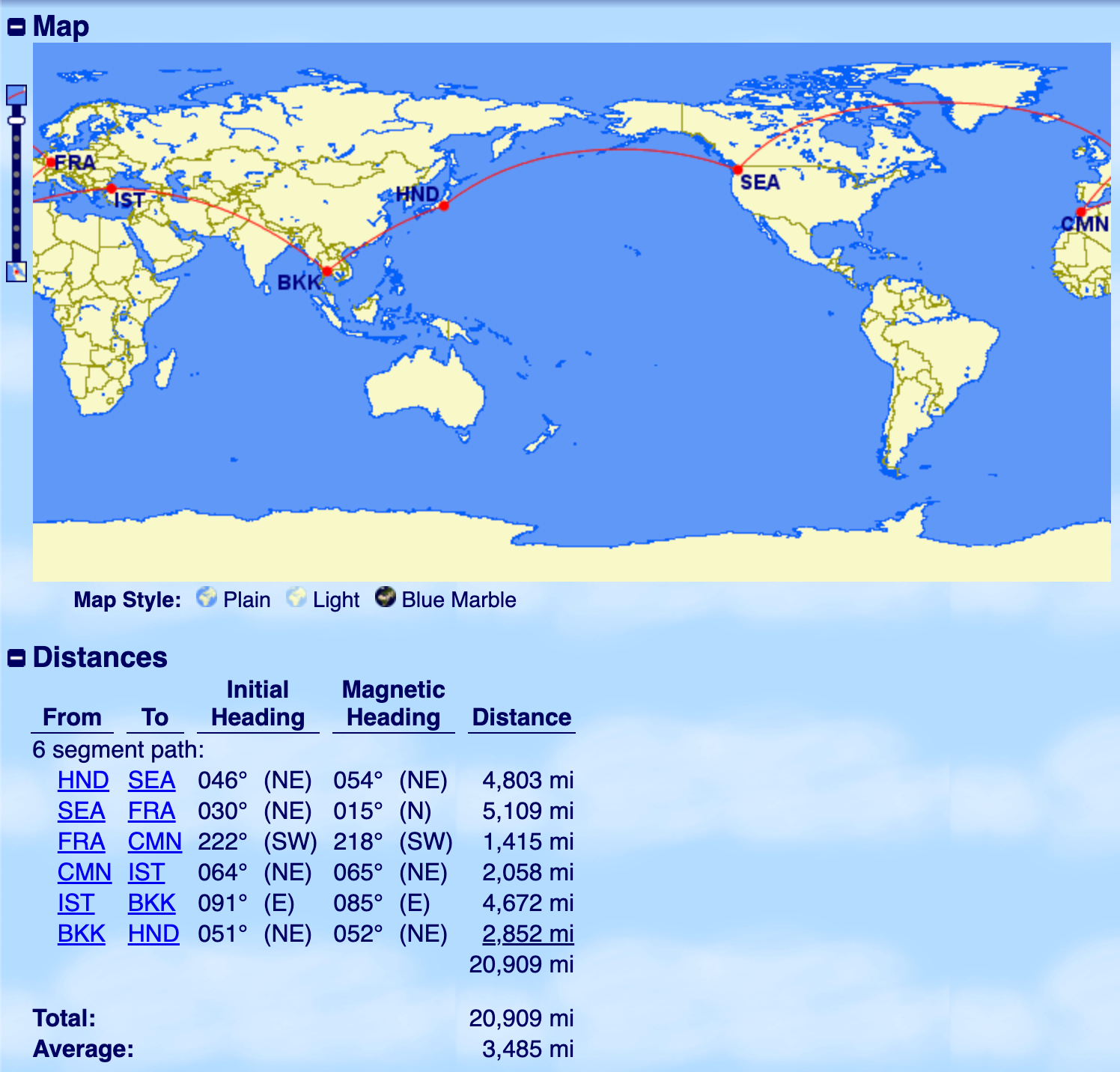

From Seattle Skies to Saharan Sunsets and Asia: A Global Getaway

This route utilizes 3 partner airlines, ANA, Lufthansa, and Turkish and will set you back just 125K Amex points. It covers 20,909 miles.

- Tokyo (Haneda) to Seattle on ANA

- Seattle to Frankfurt on Lufthansa

- Frankfurt to Casablanca on Lufthansa

- Casablanca to Istanbul and onward to Bangkok on Turkish Airlines

- Bangkok to Tokyo (Haneda) on ANA

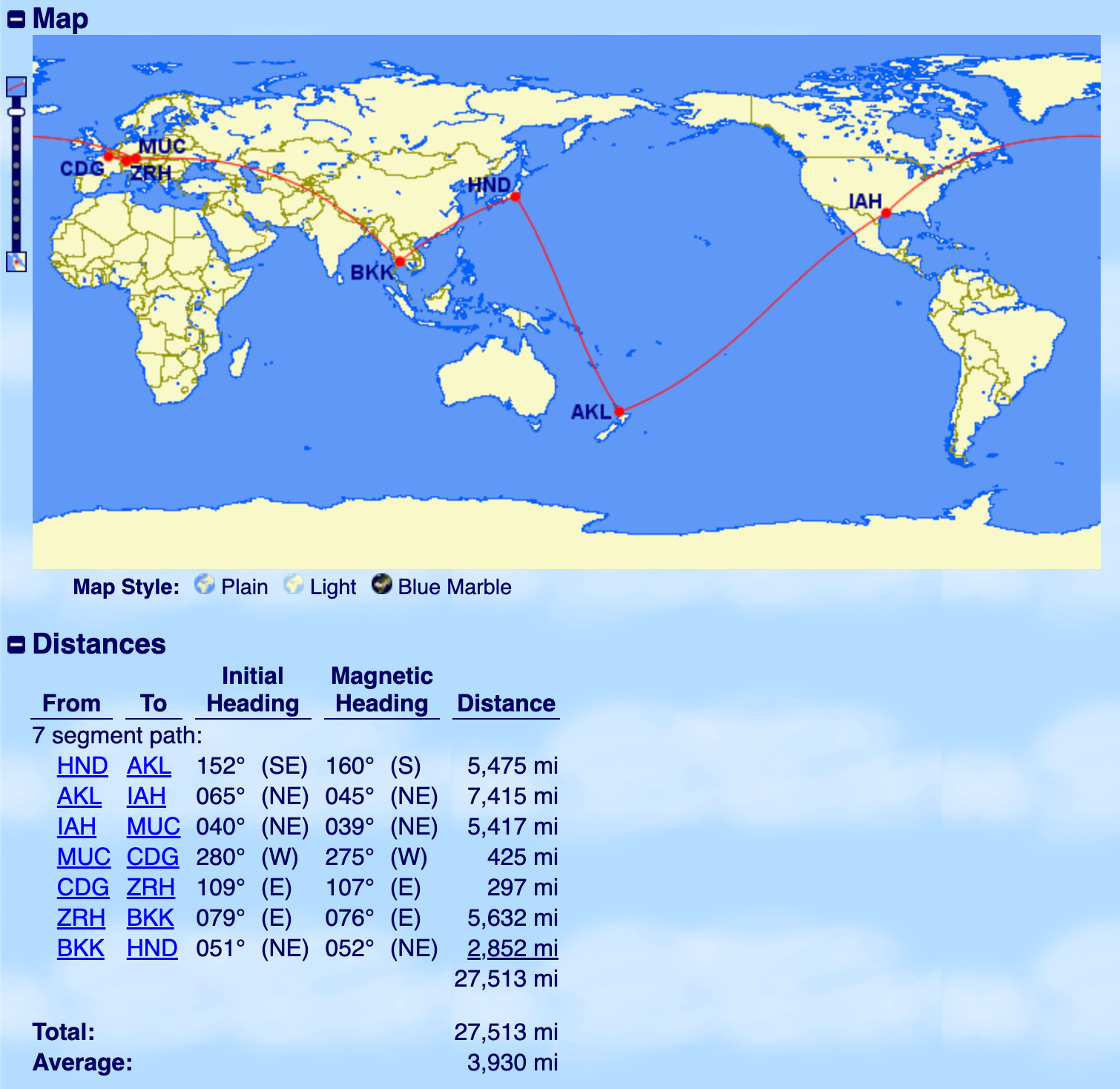

Kiwis, Cowboys, and Castles: Traversing Three Continents

Also costing 170K Amex points, this 27,513 mile route passes takes you the long way across the pacific ocean to get to the US via New Zealand.

- Tokyo (Haneda) to Auckland onward to Houston on Air New Zealand

- Houston to Munich on United Airlines

- Munich to Paris on Lufthansa

- Paris to Zurich onward to Bangkok on Swiss or Thai Airlines

- Bangkok to Tokyo (Haneda) on ANA or Thai Airways

Conclusion

In the realm of travel and points hacking, understanding credit card rewards is paramount. This guide focused on the art of earning, emphasizing how thoughtful card selections and point strategies can elevate your travel experiences. By prioritizing high-value points and recognizing the nuances of travel partner alliances, your next round-the-world award redemption is even more accessible than ever! Remember, success hinges on fine-tuning your points portfolio with a focus on transferability and earnability. Your next luxury trip is just a few card applications away. Safe travels, and happy point collecting!

Comments ()