How to Harvest Tax-Free Capital Gains During Low-Income Years: A 2025 Guide

Discover how to harvest up to $47,025 in tax-free capital gains during low-income years. Learn the exact strategy I used to save thousands in 2024 taxes

For many investors, a period without regular income - whether through sabbatical, early retirement, or career transition - presents a unique opportunity. The tax code allows you to harvest significant capital gains completely tax-free during these low-income years. Here's exactly how I harvested $36,125 in gains without paying a cent in federal taxes.

Understanding Long-Term Capital Gains Tax Harvesting in 2024

The U.S. tax code includes a fascinating provision: if your total taxable income falls within certain thresholds, you can realize long-term capital gains without owing any federal taxes. This creates a powerful opportunity for tax optimization during years when your earned income drops significantly.

In 2024, single filers can recognize up to $47,025 in qualified dividends and long-term capital gains completely tax-free at the federal level, assuming they have no other income. This threshold sits at the top of the 0% capital gains tax bracket, making it a critical number for tax planning.

Let me share my personal experience with capital gains harvesting during a low-income year. In 2024, my only income was $6,000 in qualified dividends. This meant I could harvest an additional $41,025 in long-term capital gains while staying within the 0% tax bracket. The math works like this:

- 2024 0% LTCG bracket threshold: $47,025

- Existing qualified dividend income: $6,000

- Available space for tax-free gains: $41,025

Strategic Decision-Making: Optimizing Tax-Free Income in Low-Income Years

When you find yourself in a low-income year, you typically face two primary options for tax optimization: Roth IRA conversion or long-term capital gains harvesting. Understanding the tradeoffs between these strategies is crucial for maximizing your tax advantages.

Comparing Roth Conversion vs Capital Gains Harvesting

Let's break down the key considerations for each approach in 2024:

Roth IRA Conversion:

- First $14,600 uses your standard deduction (essentially tax-free)

- Additional converted amounts taxed as ordinary income

- Permanently moves assets to tax-free growth environment

- Requires available Traditional IRA assets

Capital Gains Harvesting:

- Up to $47,025 total qualified dividends and long-term gains at 0% federal rate

- Provides immediate basis step-up in taxable accounts

- Generates liquid assets for future use

- Requires appreciated positions in taxable accounts

In my case, I faced a critical decision: should I convert $14,600 to my Roth IRA using my standard deduction and harvest a smaller amount of capital gains, or maximize my capital gains harvesting? After careful analysis, I chose to prioritize capital gains harvesting for several reasons:

- I wanted to maintain flexibility in my Traditional IRA for future business investments

- I anticipated needing taxable account liquidity in the coming years

- Many of my taxable positions had significant embedded gains that I wanted to reset

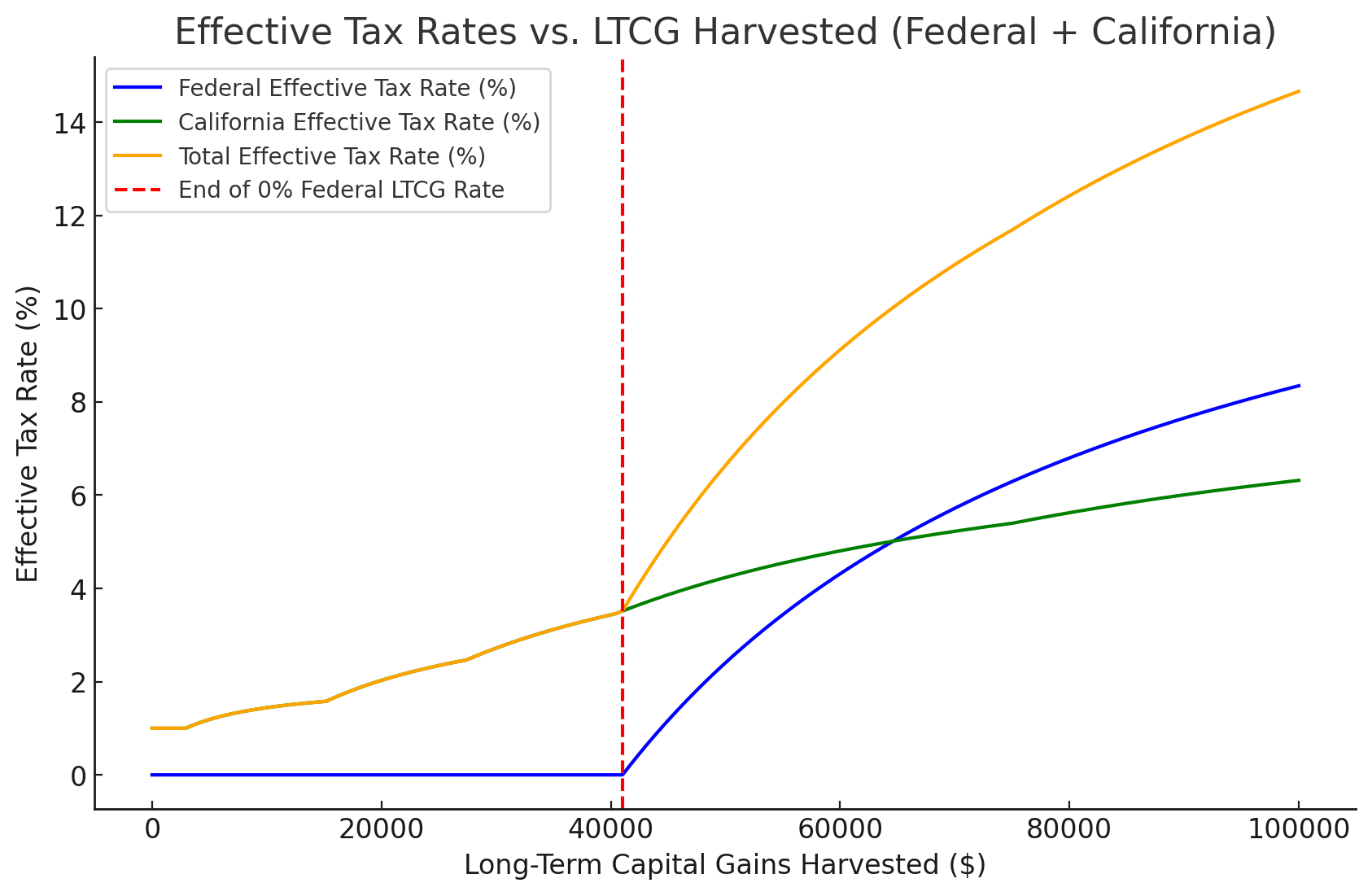

This strategic decision led me to harvest $36,125 in gains while paying only California's 4% state tax rate - a significant savings compared to my usual combined federal and state rate above 30%.

Step-by-Step Implementation: Executing Your Tax-Free Capital Gains Strategy

When implementing a capital gains harvesting strategy during a low-income year, careful execution becomes crucial. Let me walk you through my exact process of harvesting $36,125 in long-term capital gains while staying within the 0% federal tax bracket.

Position Selection and Portfolio Analysis

The first step involves analyzing your existing positions to identify the most strategic sales. In my portfolio, I held multiple individual stocks purchased years ago that no longer aligned with my investment strategy. This presented an ideal opportunity to both harvest gains and rebalance my portfolio.

Here's how I structured my harvesting strategy:

I began by identifying 14 individual stock positions that had substantial long-term gains. The total proceeds from these sales amounted to $88,000, with $36,125 representing pure capital gains. This approach allowed me to stay comfortably under my available tax-free limit of $41,025 ($47,025 threshold minus $6,000 in existing dividend income).

Portfolio Rebalancing and Reinvestment

After executing the sales, I reinvested the proceeds into VTI to rebalance my portfolio.

State Tax Implications

While federal tax treatment offers significant benefits, state taxes require careful consideration. In California, I faced a 4% tax rate on my harvested gains, resulting in approximately $1,445 in state taxes. This cost was well worth the federal tax savings and portfolio rebalancing benefits achieved.

The chart below shows how much federal and state taxes I would pay for each incremental dollar of long term capital gains harvested. The red line indicates the maximum amount of long term capital gains I can harvest, while still paying a very minimal amount of state taxes.

Conclusion: Maximizing Tax Efficiency During Low-Income Years

Strategic capital gains harvesting during low-income years represents a powerful tool for tax optimization and portfolio management. By carefully executing this strategy, I successfully harvested $36,125 in gains while paying zero federal tax and minimal state tax, simultaneously modernizing my portfolio allocation.

Remember that successful implementation requires:

- Careful income monitoring and threshold awareness

- Strategic position selection

- Thoughtful reinvestment planning

- Consideration of state tax implications

For those experiencing a low-income year, whether through choice or circumstance, understanding and implementing this strategy can provide significant long-term tax benefits while creating opportunities for portfolio optimization.

Comments ()