Savvy Sabbatical Savings: A Guide to Making Your Money Go Further

Unlock savvy sabbatical savings with expert tips on accommodation, credit card hacks, and more! Transform your travel budget smartly.

Thinking of making your sabbatical dollar stretch like a yoga master? You’ve already got the basics from my last post on sabbatical budget planning. Now, let’s delve into more advanced strategies for saving money. We’re talking about eight practical tips like saving on ATM fees, smart ways to cut down on accommodation costs, and earning credit card points for future travels. Plus, I’ll share how I used 0% APR credit card promotions to fund $30K of my sabbatical expenses.

Cutting Down Accommodation Costs

Finding economical accommodation options is a key part of managing your travel budget, whether for short stays or extended periods. Here are four strategies you can employ to lower your costs:

Maximizing Savings with Cashback Websites

Cashback sites are a practical way to get money back on your online purchases, including travel bookings. Essentially, these platforms offer a percentage of your purchase back as a reward for using their service.

For example, let's take Hotels.com – through CashbackMonitor, I found deals offering between 1.5% to 12% back on bookings. This means on a $200 hotel stay, you could get back anywhere from $3 to $24. Personally, I frequently use TopCashBack because of their expansive merchant list and consistently high cashback rates. If you’d like to support my work, you may use my TopCashBack referral link at no extra cost to you.

Airbnb Hacks: Negotiating Rates

Negotiating on Airbnb is a surprisingly underused strategy that can lead to significant savings, often between 10-20%. Your success in negotiating can depend on several factors, such as the length of your stay, your positive profile reviews, traveling during off-peak seasons, or choosing newer properties with fewer reviews.

Here’s a real-world tip: when contacting hosts, I compliment their space, mention my solo travel, highlight my positive guest history, and politely inquire about potential discounts. This approach is respectful yet effective, and it's helped me save substantially on numerous occasions, such as the one below.

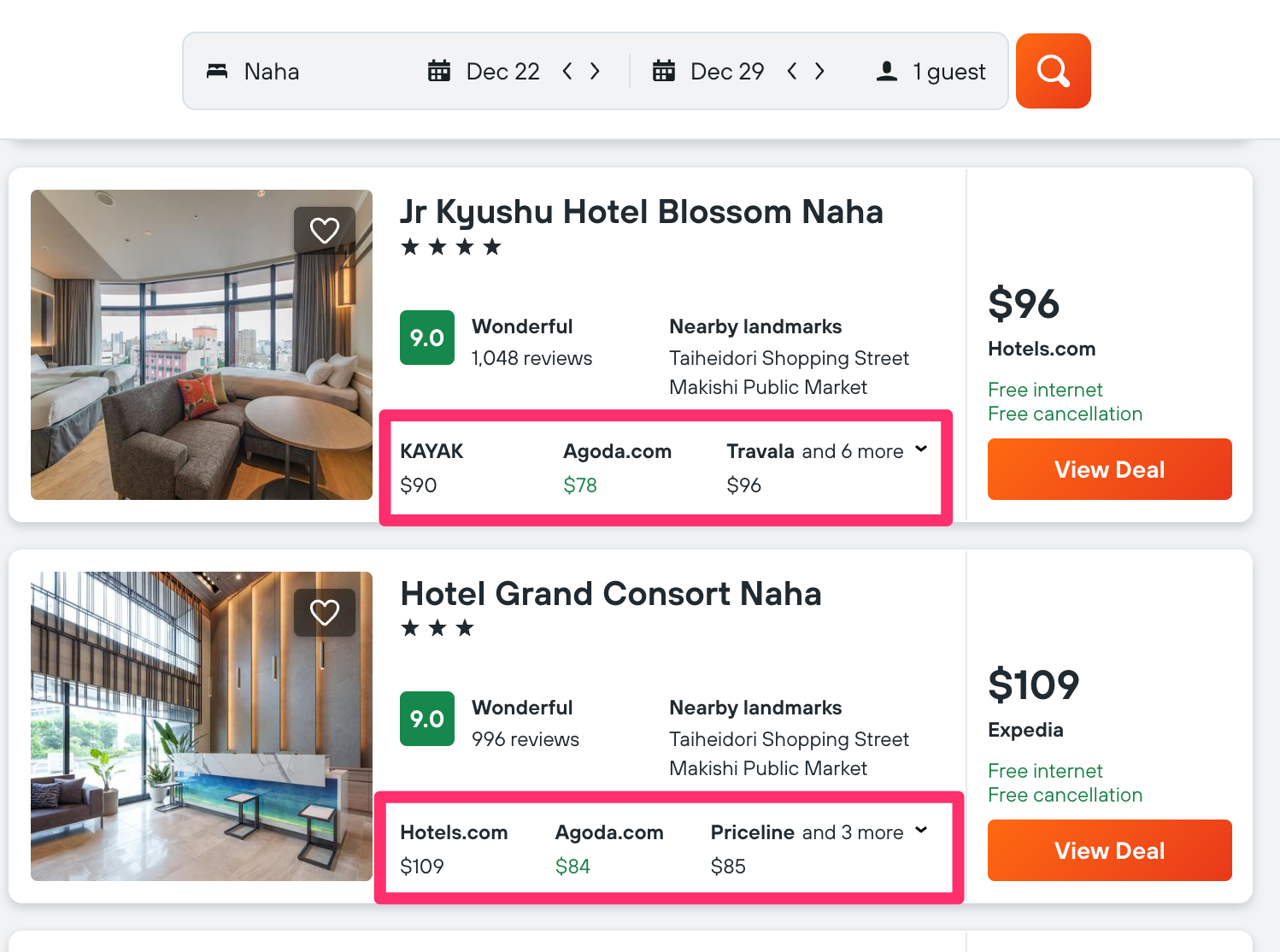

Hotel Price Comparison: Tips for the Best Deals

When booking hotels, a little comparison can lead to big savings. Hotels, to maximize visibility, list on various platforms, each charging a commission. To snag the best deals, first, use a price aggregator like Kayak. Similar to CashbackMonitor, Kayak compares prices across different booking sites, helping you choose the cheapest rates. For instance, using Kayak in the example below can help you choose the right platform saving up to 20%!

Second, consider booking directly with the hotel, either via their website or over the phone. Similar to avoiding third-party fees on food delivery apps, direct bookings can save you 10-30%. Plus, paying in local currency can further reduce costs, as I discovered in Madagascar where I saved an additional 10% this way.

Use Long-Term Rentals for Maximum Savings

Long-term rentals are a hidden gem for saving big on accommodation. In my travels, I've found that opting for a month-long stay can slash costs by up to 50% compared to the average nightly rate for shorter periods. This is particularly true with Airbnb, which tends to offer more substantial discounts for extended stays than hotels. For stays of 2 to 4 weeks, Airbnb is my go-to choice. For even longer stays, platforms like Facebook Marketplace can be valuable resources, though for solo female travelers, I recommend staying on more established platforms for safety reasons.

A tip from my personal playbook: never shy away from negotiating with Airbnb hosts. Ask if they can offer extra discounts on top of the already reduced rates for longer stays. Additionally, if you’re settling in for more than a week, consider asking to pay the host directly in cash upon arrival. This simple move can bypass the typical 15% service fee charged by Airbnb, leading to more savings for you.

Turning Every Dollar Spent into Miles

Embracing the mantra of #AlwaysBeChurning, I've turned my everyday spending into a treasure trove of travel rewards. Over the past year, I racked up 1.3 million points by spending around $60K, enough for six round-the-world trips in business class. The key? Leveraging credit cards with generous sign-up bonuses and high reward yields.

Credit Card Sign-Up Bonuses: Your Gateway to Free Travel

If you’re going to spend money anyway, why not put it on credit cards that give you a sign-up bonus? For example, spending $6,000 on a Chase Sapphire Preferred card might earn you 18,000 Chase Ultimate Rewards points. But, with the same spending, you could bag 90,000 points in sign-up bonuses from the Chase Ink Unlimited card! Overcoming the challenge of receiving cards while abroad is manageable by having them sent to a trusted person and adding them to your digital wallet for NFC payments.

Use Routine Purchases To Boost Your Travel Points

Not keen on constantly switching cards? Then focus on maximizing points with your current travel cards. Cards like the Amex Platinum, Chase Sapphire variants, and Citi Premier, offer between 2-3x points per dollar, turning every purchase into a step closer to your next adventure.

Fee-Free ATM Withdrawals During Your Sabbatical

Did you know you can dodge those pesky ATM and foreign exchange fees? In my travels, I've found a secret weapon – a debit card that offers free withdrawals worldwide at actual exchange rates. Last year alone, this saved me around $100 in fees. Though I'm a big advocate of using credit cards for points and easy expense tracking, there's always a need for some cash in hand for small, local purchases. ATMs can charge anywhere from $1 to $8 per withdrawal, and these costs add up fast. For example, I incurred almost $25 in ATM fees while touring Madagascar for a month – and was reimbursed by Schwab promptly at the end of the month.

With no foreign transaction fees and unlimited ATM fee rebates, not to mention no monthly service fees or minimum balance requirements, the Schwab Bank Investor Checking account has eliminated the need for money changers. This isn’t a sponsored ad, it's a game-changer for travelers seeking to minimize unnecessary fees.

Leveraging 0% APR Promos For Sabbatical Financing

Ever thought about funding your sabbatical with a 12-month, interest-free loan? Imagine diverting that budgeted money into a high-yield 5% savings account. For every $10K invested, you could earn $500 in interest annually. I've employed this strategy with around $20-30K in 0% APR debt, and by the end of my sabbatical in 2024, I anticipate earning about $1,500 in interest.

You can take this a step further by rolling the existing debt into a new 0% APR card using balance transfers — a strategy I’ll delve into in a future post.

Wrapping Up: Your Turn to Share Travel-Saving Tips!

And there you have it, my comprehensive guide on stretching your sabbatical budget. From savvy accommodation hacks to smart credit card plays, these strategies are designed to make every cent count. But now, I'm curious to hear from you! Have you tried any of these methods, or do you have other tricks up your sleeve? Share your stories and tips in the comments below. Happy and savvy travels!

Comments ()